2020-21 Annual Report

South Australia’s visitor economy continues to be significantly impacted by the ongoing and world-wide effects of the COVID-19 pandemic. This virus has and will continue to throw our industry curve balls and challenge us to do things differently. Each day I am inspired and in awe of our hardworking tourism operators who rise to these challenges and continue to innovate, pivot and pirouette as we adjust to the new COVID-normal.

But it has not been easy. Having experienced the most severe contraction of tourism on record, we’ve seen our $8.1 billion visitor economy decrease to $4.4 billion in the year to March 2021. The latest results for the June 2021 year end have seen expenditure recover to $5.8 billion, ahead of our original impact forecast of $4.9 billion. In fact, our model is now anticipating a recovery of the visitor economy to $6.3 billion by June 2022, as we pursue our ambitious 2030 target of $12.8 billion. The initial recovery has been led by strong growth in interstate expenditure over the last quarter and the record high intrastate expenditure in response to the easing of COVID-related travel restrictions. While positive, we could expect to see fluctuations in the data in the coming months and year due to the ever changing nature of this pandemic.

Nonetheless, it is clear South Australians are keen to do their bit for our economy by holidaying at home. There is also a huge opportunity to tap into a growing domestic market and challenge South Australians to redirect some of the $3.3 billion that was spent overseas in 2019 to tourism experiences here in our state.

Our focus over the past financial year has been on helping our visitor economy recover as quickly as possible so we can get back on track to reaching our 2030 goals.

To this end, we’ve delivered key initiatives to support our industry including the Great State Voucher program, focussed our marketing efforts on the intra and interstate markets, administered the $20 million Tourism Industry Development Fund and delivered three managed events in COVID-safe formats.

While it’s promising to see occupancy data for hotels showing strong recovery in the regions, assisted by the Great State Voucher program, there is more to be done. Adelaide hotels are yet to return to occupancy levels comparable to the pre-COVID period and we are working with industry and local government to activate our CBD by encouraging people to spend more time and money in the city.

As we chart our way out of the pandemic, we clearly understand that that the only way we can move out of restrictions and border closures is to significantly increase our national vaccination rates.

I would like to thank our state’s tourism industry and the State Government for continuing to work with us on this journey. Together we look forward to driving the recovery of our visitor economy and for the opportunity to make a difference to South Australia.

Rodney Harrex

Chief Executive | South Australian Tourism Commission

Our Purpose

Our role under the South Australian Tourism Commission Act 1993 is to assist in securing economic and social benefits for the people of South Australia through promoting the state as a tourism destination and further developing and improving the state’s tourism industry.

Our Vision

To grow the visitor economy in South Australia to $8.0 billion by December 2020 and boosting direct employment in tourism by 10,000 additional jobs.

The South Australian Visitor Economy Sector Plan 2030 sets a bold ambition to grow our visitor economy further to $12.8 billion, generating 16,000 additional jobs.

Our Values

Go Boldly - We thrive on taking risks and enjoy stepping outside our comfort zone.

Dig Deeper - We never settle for simply scratching the surface. We’re hungry for knowledge, fresh ideas and innovations.

Can Do - We believe there’s nothing we can’t do as a team.

Share The Love - We have a passion for excellence and exceeding expectations.

Our functions, objectives and deliverables

To help us achieve our vision, our work is guided by six strategic priorities, outlined in the South Australian Visitor Economy Sector Plan 2030:

- Marketing

- Experience and supply development

- Collaboration

- Industry capability

- Leisure and business events

- Promoting the value of tourism

Our organisational structure can be accessed on our corporate website, here.

During 2020-21 the following change to the agency’s structure and objectives was implemented as a result of internal reviews or machinery of government changes.

- Following the decision to cease staging the Superloop Adelaide 500, a restructure of the Events South Australia group occurred. The Events South Australia group restructure resulted in an increased focus on event acquisition and development.

The Hon Steven Marshall MP is the Premier of South Australia. He oversees Aboriginal Affairs and Reconciliation, Defence and Space Industries, Tourism, The Arts, Veterans' Affairs and Multicultural Affairs.

Rodney Harrex is the Chief Executive Officer, responsible for leading our agency to grow tourism in South Australia and increase the recognition of the value of tourism and its contribution to employment in our state.

Hitaf Rasheed is the Executive Director of Events South Australia, responsible for growing events in South Australia and attracting new events to the state to round out our events calendar. She also leads the management and delivery of the Santos Tour Down Under, Tasting Australia, National Pharmacies Christmas Pageant and Bridgestone World Solar Challenge.

Brent Hill is the Executive Director of Marketing, responsible for developing and delivering marketing activity that promotes all that South Australia has to offer. The current focus is on stimulating visitation post COVID-19 and keeping South Australia top of mind as a compelling and accessible holiday destination.

Stephanie Rozokos is the Chief Financial Officer, responsible for driving the financial, business services and cultural direction of the agency, leading the finance, contracts, procurement, risk management, human resources and information communications technology functions.

Nick Jones is the Executive Director, Destination Development, responsible for increasing accessibility to South Australia, attracting new hotel and infrastructure development, and regional tourism development.

South Australian Tourism Commission Act 1993

South Australian Motor Sport Act 1984

Major Events Act 2013

South Australia’s visitor economy continues to be significantly impacted by the ongoing and world-wide effects of the COVID-19 pandemic. International travel bans, lockdowns and border closures across Australia have all taken a toll on our state’s tourism industry. Having not only realised but exceeded our 2020 target of growing South Australia’s visitor economy to its record $8.1 billion one year early in December 2019, 2020-21 has provided a stark contrast.

We have experienced the most severe contraction of tourism on record and seen our $8.1 billion visitor economy decrease to a low of $4.4 billion in the year to March 2021. The latest results for the June 2021 year end have seen expenditure recover to $5.8 billion, up on the post COVID low of $4.4 billion and ahead of our original impact forecast of $4.9 billion (see table below). Our model is now anticipating a recovery of the visitor economy to $6.3 billion by June 2022. The initial recovery has been led by strong growth in interstate expenditure over the last quarter and the record high intrastate expenditure in response to the easing of COVID-related travel restrictions. As mentioned earlier, these are positive trends early in the recovery

process – however due to the uncertainly of borders and the ongoing impacts of COVID-19, our analysis suggests there are many variable months ahead – and a long way to go to get back to our pre-COVID record high.

To support our state’s tourism industry in the wake of the pandemic, during 2020-21, the SATC implemented three significant initiatives.

Great State Vouchers

Launching in October 2020, the Great State Voucher stimulus program provided consumers with a $100 voucher for participating CBD accommodation or $50 for regional and suburban accommodation. It proved very popular, with 50,000 vouchers snapped up in 90 minutes. A second accommodation round was made available in January 2021 and a third round, supporting experience and tour operators across the state went live in late April 2021. A fourth round, targeted to accommodation opened in May 2021 with the travel period running from 2 June to 31 August 2021. In total, these four rounds of the scheme have injected more than $60 million into our visitor economy, with 117,500 vouchers redeemed, giving the tourism industry a much-needed boost.

Tourism Industry Development Fund (TIDF)

The TIDF is a $20 million fund, designed to support and stimulate private sector investment in new and improved regional accommodation, and the development of quality tourism product and experiences. It aims to assist in the COVID recovery of regional tourism by encouraging regional operators to improve and diversify so they can attract more visitors and get a higher return on their offering. It opened for applications in September 2020, with the first successful projects announced in December 2020. As of 30 June 2021, a total of $8.3 million in grants had been allocated to 53 projects with a project value of over $31.6 million, creating almost 800 jobs.

COVID Awareness Training and COVID Marshal Training

In August 2020, the SATC supported SA Health to develop the COVID Marshal certification. The SATC had experience in this area, having worked with Health Safety Environment Australia to develop free COVID Awareness Training for the tourism industry in May 2020. The COVID Awareness Training ran for 12 months from May 2020 and ended in May 2021, in that time more than 9,800 participants completed the course. As of 21 August 2020, the COVID Marshal requirement came into effect for many South Australian businesses. The SA Health COVID Marshal training took participants through the fundamentals of infection and prevention control for COVID-19, as well as the roles and responsibilities of a COVID Marshal in South Australia.

The following includes a brief summary of the agency’s high level contributions to the Government’s objectives.

More jobs

Generate 16,000 additional jobs in the visitor economy by December 2030. Latest data shows employment reached 40,400 as of 2019-20. Since the South Australian Visitor Economy Sector Plan 2030 was released, 4,000 jobs have been created. The full impact of COVID-19 on employment will not be seen until we receive the 2020-21 State Tourism Satellite Accounts in June 2022.

Lower costs

The SATC provides services that benefit South Australian tourism operators through lowering costs associated with doing business. This includes:

Delivering the following Growth State Initiatives:

-

- Tourism Infrastructure Development Fund – to support and stimulate private sector investment in new and improved regional accommodation, and the development of quality tourism product and experiences with a focus on the recovery of regional tourism post COVID-19.

- Tourism Airline Support – Partnership with Adelaide Airport and Air New Zealand to operate flights between Adelaide and Auckland.

- Marketing of South Australia – funding to increase marketing with the aim of boosting international and domestic visitors to the state.

- The SATC delivered four rounds of the Great State Voucher stimulus program, supporting accommodation, experiences, and tour operators both in the Adelaide CBD and regional South Australia.

- The SATC covers the listing fees for South Australian tourism operators who list their products through the Australian Tourism Data Warehouse, a digital database and multi-channel distribution network for tourism data, industry products and destination information.

- The SATC’s marketing campaigns provide promotion opportunities for a range of operators across the state. This includes making footage captured available for operators and regions to use in their own marketing.

- Industry events and products are promoted through the SATC website and social media platforms, which are at a nil cost to the operator.

- Events South Australia provides sponsorship to leisure events throughout the year through its funding programs. This includes the Leisure Events Bid Fund and the Regional Events Fund.

- The SATC continues to seek opportunities to secure new major leisure events for South Australia to build the state’s event calendar.

- Eleven Regional Tourism Organisations (RTOs) continued to receive funding from the SATC to support their role as the key contact between the SATC and regional stakeholders and industry.

Better Services

Since 2016, the SATC has provided funding to the Tourism Industry Council of South Australia (TiCSA), the state’s peak body for tourism, to assist its industry capability building programs and to provide service excellence training to tourism operators on a range of topics such as social media basics and online distribution and customer relationships.

The SATC provided significant funding to assist in the running of the Visitor Economy Restart Conference.

The SATC provides support to industry through the provision of accurate, relevant, and concise research insights to assist industry in making informed business decisions, especially in relation to changed consumer behaviours post- COVID-19. It also works across key government agencies to provide timely advice and support to the sector.

The SATC’s key 2020 targets, outlined in the South Australian Tourism Plan 2020, were to grow the state’s visitor economy to $8 billion, creating another 10,000 direct tourism jobs to 41,000. Due to the unprecedented growth in tourism in the years leading up to 2020, the $8 billion target was achieved and exceeded one year early.

As of December 2019, the state’s visitor economy was worth a record $8.1 billion. Direct tourism employment was at 40,500, just shy of the 10,000 target.

The key focus areas to achieve these targets were Driving demand, Working better together, Supporting what we have, Using events to drive visitation and Increasing recognition of the value of tourism.

Looking ahead, the 2030 ambition is to grow the visitor economy to $12.8 billion, generating 16,000 additional jobs. To reach this bold vision, The South Australian Visitor Economy Sector Plan 2030 sets out six priority areas for industry development. They are Marketing (previously Driving demand), Experience and supply development (previously Working better together), Collaboration (previously Working better together), Industry capability (previously Supporting what we have), Leisure events (previously Using events to grow visitation) and Promoting the value of tourism (previously Increasing recognition of the value of tourism).

COVID-19 has led to the biggest contraction of tourism on record and this is reflected in the latest data which provides the full 12 month impact of the pandemic. As of June 2021, our state’s visitor economy is worth $5.8 billion. While this is in stark contrast to the record $8.1 billion visitor economy we enjoyed in 2019, it is ahead of our original impact forecast of $4.9 billion. In terms of tourism employment, the latest figures we have are for 2019-20, which show there were 40,400 people employed in the sector. We will not see the full effect of COVID-19 on employment until we receive the 2020-21 State Tourism Satellite Accounts in June 2022.

| Agency objectives |

Indicators

|

Performance

|

| Driving Demand | Limit the decline in the value of our tourism sector to $4.9 billion per annum by June 2021 (on the way to our December 2030 target of $12.8 billion). | Target achieved: The value of South Australia’s tourism sector fell 11 per cent to $5.8 billion in the year to June 2021 |

| Driving Demand | Limit the decline in tourism direct employment to 26,700 by June 2021 and 52,000 by 2030. June 2020 target was 34,700. | Target achieved: The latest data shows direct employment in the tourism sector held steady at 40,400 in the year to June 2020. NB: The full effect of the pandemic on tourism jobs will not be seen until we receive the 2020-21 State Tourism Satellite Accounts in June 2022. |

| Driving Demand | Limit the decline in international tourism expenditure in South Australia to $69 million by June 2021 with a milestone of $3.3 billion by December 2030. | Target not achieved: The value of South Australia’s international tourism fell 96 per cent to $34 million in the year to June 2021 |

| Driving Demand | Limit the decline in interstate overnight expenditure in South Australia to $869 million by June 2021 and intrastate overnight expenditure to $2.4 billion. | Target achieved: The value of South Australia’s interstate tourism sector reached $1.7 billion and intrastate reached $2.6 billion in the year to June 2021 |

| Working Better Together |

Work with the regions in developing the Regional Visitor Strategy to drive regional expenditure to $4.0 billion by 2025 and $5.1 billion by 2030. | Target Achieved: The 2025 South Australian Regional Visitor Strategy (RVS) launched in March 2021 and is the second version which brings together the priorities of all 11 regions. The strategy outlines priorities and focus areas for the regional tourism to achieve its 2025 target of $4 billion expenditure and aligns with the South Australian Visitor Economy Sector Plan 2030 to support creating new jobs and growing visitor expenditure in regions. |

| Supporting what we have | Drive industry training initiatives, such as COVID-Aware, to ensure industry emerges from the crisis ready to adapt to new conditions. | Target Achieved: Over 9,800 participants from South Australian tourism and hospitality businesses undertook the COVID-19 Awareness Training Course facilitated by the SATC and Health Safety Environment Australia (HSEA). In August 2020, the SATC supported SA Health to develop the COVID Marshal certification. The SATC had experience in this area having developed the COVID Awareness Training with HSEA in May 2020. |

| Increasing the Recognition of the value of tourism |

Provide accurate, relevant and concise research insights to assist industry to make informed business decisions, especially in relation to changed consumer behaviours post- COVID-19. | Target Achieved: The SATC continues to work with Tourism Research Australia and Austrade to provide the latest results on the movement of intrastate visitors within the state and interstate visitors from outside of SA. The SATC has continued to maintain the suite of over 50 factsheets published to our Corporate Website, adapting where required to better suit user needs in assessing COVID impacts. |

| Increasing the Recognition of the value of tourism |

Promote the value of tourism to government and the wider industry through a suite of targeted industry and public communications. | Target achieved: Increased engagement with industry and media. The SATC continued to showcase businesses and events that contribute to the state’s visitor economy. Increased media activity – both in traditional and social platforms – have broadly increased the understanding of the sector. Provided clear communications around constantly evolving nature of events. SATC Corporate Facebook followers grew 142 per cent, and engagement grew from 12,000 to 15,000. Twitter followers increased by 10.2 per cent, with an increase in engagement level by 1 per cent. Instagram now has 14,500 followers and has achieved 1 million post impressions. The SATC Corporate website also grew in reach, with 589,292 page views - an increase of 94 per cent. The Great State Voucher was a key campaign during this period, with 165,118 visitors to the page. |

| Using Events to Grow Visitation |

Increase the economic value of events to the full potential of $750 million by 2030 with a March 2021 waypoint of $198 million. | Target not achieved: The value of South Australia’s leisure events sector fell 63 per cent to $152 million in the year to March 2021 (latest figures available at time of publication). COVID-19 had a significant impact on events and festivals with numerous cancellations and postponements. |

| Using Events to Grow Visitation |

Deliver a program of 'owned' events to drive visitation and raise the profile of the state as a world class event destination, using COVID-19 related restrictions to drive innovation and ensure the existing event related business in the state are supported in the appropriate manner. |

Target achieved: In the 2020-21 financial year, Events South Australia presented three managed events: 2020 National Pharmacies Christmas Pageant, 2021 Santos Festival of Cycling (in lieu of an international 2021 Santos Tour Down Under) and 2021 Tasting Australia presented by RAA Travel. |

| Using Events to Grow Visitation |

Focus event sponsorships on core strength areas such as food and wine, arts and culture, live music, national and international sports and mass participation events, with a focus on off-peak periods (particularly winter) and utilising key infrastructure. | Target achieved: In 2020-21, a total of 44 events, comprising 15 major events and 29 regional events within the Regional Events and Festival Program (REFP) were sponsored. 12 major events were staged but due to the ongoing impacts of COVID-19, three major events were postponed or rescheduled and five were cancelled. Sponsored Event Highlights included:

|

| Using Events to Grow Visitation |

Events are managed and run in South Australia in the COVID-19 and post-COVID-19 world, seeking innovative solutions to new challenges and ensuring the industry is supported in the appropriate manner. |

Target Achieved: To the extent possible in light of restrictions, Events have been adapted to meet contact tracing, distancing and density requirements as well as border restrictions and the requirement for seating at large concerts. During this time, events have adopted QR codes in order to contact trace, have moved from freeflowing parades and concerts to seated events with designated zones or pods and have adopted online food and drink ordering capabilities to reduce congestion. Events South Australia has contributed to this through funding support, providing advice, communication paths to SA Health and through the execution of the National Pharmacies Christmas Pageant, Santos Festival of Cycling and Tasting Australia presented by RAA Travel. |

The SATC continued to administer a range of processes and practices in delivering its responsibilities under the South Australian Tourism Act 1993 and in adherence to government financial, procurement, contracting, human resources, ICT, governance, risk management and auditing requirements.

The SATC maintains a high level of financial control over its destination development, events and marketing operations to ensure accountability for government resources. The SATC ended the 2020-21 financial year in line with budget and met all savings targets required.

In 2020-21, the SATC continued to provide a safe working environment including a range of workplace measures to minimise the risk of COVID-19. These measures included new technologies, increased flexible working practices, appropriate hygiene measures and support for individual health and wellbeing. The SATC provided staff with a range of initiatives aimed at promoting physical and mental wellbeing.

Staff took part in the SATC’s annual staff engagement survey in December 2020. This survey provided an objective mechanism for assessing the cultural environment. Results from the survey were consistent and reported high levels of staff engagement, well above available industry benchmarks. Individual performance reviews were used to identify both organisational and individual learning and development needs and opportunities.

The SATC’s values are promoted within the organisation. The ‘Culture and Values’ working group aims to drive and influence the agency’s culture through staff engagement and implementation of initiatives which endorse the SATC values. In 2020-21, the COVID-19 pandemic has continued to be a major focus from a staff health and wellbeing perspective.

SATC student placement program

The SATC works with local higher education providers to offer placements to students currently enrolled in courses related to tourism, marketing and events. In 2020-21, six student placements were supported.

Aboriginal employment strategy

In line with the deliverables of SATC’s first Reconciliation Action Plan, the SATC works across Government and with local higher education providers to promote employment opportunities to Aboriginal and Torres Strait Islander candidates.

Skilling SA

The SATC supports one apprentice and is working with the Office of the Commissioner for Public Sector Employment to engage another apprentice in our ICT team in the latter half of 2021.

Performance Employee Performance Management and Development Reviews

(Compliance measured via a custom-made online recording tool)

All employees are required to have individual performance management and development plans reviewed as a minimum on a biannual basis.

In 2020-21, 95 per cent of employees had a current performance review in place (the 5 per cent without plans include employees on periods of extended leave).

Employee Performance Management and Development Training

The SATC delivers in-house training to ensure employees have the knowledge required to complete biannual reviews.

All employees, with the exception of 11 new starters that have commenced since 1 June 2021, have attended training relating to SATC’s current performance management and development review process.

Training Needs Analysis (TNA)

A TNA is conducted using information captured within Employee Performance Management and Development Reviews. From this, individual and group learning and development activities are identified.

Work Health and Safety Briefings and Induction

All employees are required to attend a Work, Health and Safety briefing on joining the agency. Refreshers are delivered on a regular basis to ensure knowledge remains current.

Contractors engaged by the SATC to undertake work on its sites are provided with site specific inductions and where required, provided with safety specific Work, Health and Safety documentation and briefings.

Work Health and Safety Policies and Procedures

The SATC has a suite of policies and procedures which address Work, Health and Safety matters and outline safe working practices. Polices are reviewed on an annual basis to ensure they remain current.

Work, Health and Safety Management Plans are created for events and are reviewed yearly. All construction works conducted by the SATC are accompanied by the relevant Work, Health and Safety Management Plans as required by law, and regular inspections are conducted to ensure the requirements of the plans are carried out.

Work Health and Safety Training

The SATC has a specific Work, Health and Safety training needs analysis in place in order to identify required Work, Health and Safety training for individual roles. The SATC supports the appointment of two trained Bullying and Harassment Contact Officers.

Work Health and Safety Committee

The SATC’s Work, Health and Safety Committee meets four times annually. The Committee provides a forum for management and employees to discuss Work, Health and Safety matters and acts as the key Work, Health and Safety mechanism.

Employee Assistance Program (EAP)

The SATC provides a free and confidential EAP to employees. The SATC’s EAP provider also delivers wellbeing sessions to employees on a biannual basis.

Health, Safety and Wellbeing Initiatives

Human Resources and Work, Health and Safety teams work to deliver a calendar of initiatives aimed at promoting physical and mental wellbeing. The SATC’s Culture and Values Working Group provides a forum to drive and influence the agency’s culture through staff engagement and implementation of initiatives which focus on staff health and wellbeing.

| Workplace injury claims |

2020-21

|

2019-20

|

% Change

( + / -)

|

| Total new workplace injury claims |

1

|

1

|

NA

|

| Fatalities | 0 | 0 | NA |

| Seriously injured workers* | 0 | 0 | NA |

| Significant injuries (where lost time exceeds a working week, expressed as frequency rate per 1000 FTE) | 0 | 8.7 | NA |

*number of claimants assessed during the reporting period as having a whole person impairment of 30% or more under the Return to Work Act 2014 (Part 2 Division 5)

| Work health and safety regulations |

2020-21

|

2019-20

|

% Change

( + / -)

|

| Number of notifiable incidents (Work Health and Safety Act 2012, Part 3) |

0

|

1

|

-100%

|

| Number of provisional improvement, improvement and prohibition notices (Work Health and Safety Act 2012 Sections 90, 191 and 195) | 0 | 0 | NA |

| Return to work costs** |

2020-21

|

2019-20

|

% Change

( + / -)

|

| Total gross workers compensation expenditure ($) |

$20,641 |

$395

|

+5,125%

|

| Income support payments – gross ($) | $13,402 | $0 | NA |

**before third party recovery

Data for previous years is available at: https://data.sa.gov.au/data/dataset/work-health-and-safety-and-return-to-work-performance-reporting-south-australian-tourism-commission

Executive classification and number of executives

EXECOA - 1

EXECOB - 2

EXECOC - 1

EXECOE - 1

Data for previous years is available at: https://data.sa.gov.au/data/dataset/executive-employment-reporting-south-australian-tourism-commission

The Office of the Commissioner for Public Sector Employment has a workforce information page that provides further information on the breakdown of executive gender, salary and tenure by agency.

|

Statement of Comprehensive Income for year ended 30 June |

2020-21

$'000

|

2019-20

$’000

|

| Income | 94 114 | 113 753 |

| Expenses | 88 062 | 111 338 |

| Net result | 6 052 | 2 415 |

| Total comprehensive result | (620) | 2 415 |

| Statement of Financial Position as at 30 June |

2020-21

$'000

|

2019-20

$’000

|

| Current assets | 34 379 | 23 301 |

| Non-current assets | 8 069 | 21 473 |

| Total assets | 42 448 | 44 774 |

| Current liabilities | 9 403 | 9 558 |

| Non-current liabilities | 7 485 | 9 036 |

| Total liabilities | 16 888 | 18 594 |

| Equity (net assets) | 25 560 | 26 180 |

Financial report audit opinion: unmodified.

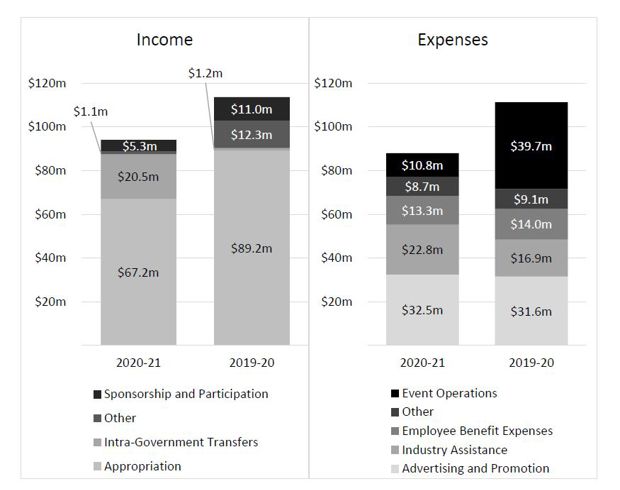

The following graphs show the main items of income and expense for 2020-21 and 2019-20.

The following is a summary of external consultants that have been engaged by the agency, the nature of work undertaken, and the actual payments made for the work undertaken during the financial year.

Consultancies with a contract value below $10,000 each

| Consultancies | Purpose | Actual payment |

| Nil | Nil | Nil |

Consultancies with a contract value above $10,000 each

| Consultancies | Purpose | Actual payment |

| Droga & Co Pty Ltd | Design of regional visitor strategy | $32,130 |

Data for previous years is available at: https://data.sa.gov.au/data/dataset/consultants-reporting-south-australian-tourism-commission

See also the Consolidated Financial Report of the Department of Treasury and Finance for total value of consultancy contracts across the South Australian Public Sector.

The following is a summary of external contractors that have been engaged by the agency and the nature of work undertaken, where the actual payments made for work undertaken during the financial year was AUD $10,000 (or equivalent) or greater.

| Contractor | Purpose |

| 17 Tours Pty Ltd | Event management services |

| 1834 Hospitality Pty Ltd | Cooperative marketing |

| AAPC Ltd | Cooperative marketing |

| Acuity Partners Pty Ltd | Procurement services |

| Adagold Aviation Pty Ltd | Transport services |

| Adelaide Contract Services Pty Ltd | Event operations services |

| Adelaide Event Group | Event infrastructure services |

| Adelaide Event Operations Pty Ltd | Event operations services |

| Australian Green Clean (Events) Pty Ltd | Cleaning and waste services |

| Adelaide Oval SMA Ltd | Event facilities and catering |

| Adelaide Sign Group Pty Ltd | Tourism infrastructure |

| Adobe Australia Trading Pty Ltd | Digital marketing services |

| Advanced Tent Technology Pty Ltd | Event infrastructure services |

| Advertiser Newspapers Pty Ltd | Advertising services |

| Agile Group (Global) Pty Ltd | Security services |

| Allfab Australia Pty Ltd | Event infrastructure |

| Alliance Airlines Pty Ltd | Transport services |

| Alpaca Travel Pty Ltd | Digital services |

| Altus Traffic Pty Ltd | Traffic management services |

| Apollo Lighting Service Pty Ltd | Event production services |

| Artcraft Pty Ltd | Tourism and event infrastructure |

| Arte Grafica Printing Pty Ltd | Printing services |

| ATF Services Pty Ltd | Event infrastructure services |

| Atomix Design Pty Ltd | Creative/design services |

| Auscycling Ltd | Event operations services |

| Australian Green Clean (Events) Pty Ltd | Cleaning and waste services |

| Australian Sports Medicine Federation SA Branch Inc | Event operations services |

| Australian Tourism Data Warehouse Pty Ltd | ICT services |

| Australian Tourism Export Council Ltd | Training services |

| Australian Trade and Investment Commission | Market research |

| Awkar Pty Ltd | Catering services |

| AYBS Pty Ltd | Temporary staff (catering) |

| Bastion Insights Pty Ltd | Market research |

| BDA Marketing Planning Pty Ltd | Market research |

| BenFx Lighting | Event infrastructure services |

| Bianco Hiring Service Pty Ltd | Event infrastructure services |

| Big Fish Events Group | Event management services |

| Big Screen Video Pty Ltd | Event infrastructure services |

| Big4 Holiday Parks of Australia Pty Ltd | Cooperative marketing |

| Bikesport Australia Pty Ltd | Event management services |

| Bikesportz Imports Pty Ltd | Event operations services |

| Bizar Mobile Pty Ltd | Digital services |

| Boltz Pty Ltd | Event infrastructure services |

| Boyd Public Relations Ltd | Public relations services |

| Brian Gleeson Event Management Pty Ltd | Event management services |

| Broadsheet Media Pty Ltd | Advertising services |

| Budget Car and Truck Rental (SA) | Transport services |

| Budget Rent a Car Australia Pty Ltd | Transport services |

| Bunnik Travel Pty Ltd | Cooperative marketing |

| Calicoan Pty Ltd | Event production services |

| Carat Australia Media Services Pty Ltd | Advertising services |

| Carat New Zealand Ltd | Advertising services |

| Caravan & Camping Industries Association of SA Inc | Cooperative marketing |

| Ceduna Community Hotel Ltd | Accommodation services |

| Channel 9 South Australia Pty Ltd | Advertising services |

| Chicken and Bees Pty Ltd | Promotional services |

| Christopher Selwood | Event management services |

| Cirka Pty Ltd | Cleaning and waste services |

| Civil Tech Pty Ltd | Event infrastructure services |

| C J Rischbieth and T J Rischbieth | Accommodation services |

| Coates Hire Operations Pty Ltd | Event infrastructure services |

| Colmar Brunton Pty Ltd | Market research |

| COR Berlin Kommunikation GmbH | Public relations services |

| Coriole Vineyards | Event catering services |

| Corporation of the City of Adelaide | Event infrastructure services |

| Crawford Containers Pty Ltd | Event infrastructure services |

| CSC Corporate Domains Inc | ICT services |

| CSE Crosscom Pty Ltd | Event infrastructure services |

| Cycling Australia Ltd | Event operations services |

| D77 Pty Ltd | Transport services |

| D’Arenberg Pty Ltd | Event catering services |

| Data #3 Ltd | ICT services |

| David Clarke | Creative/design services |

| Dell Australia Pty Ltd | ICT services |

| Deloitte Access Economics Pty Ltd | Training services |

| Digital Noir Pty Ltd | Digital services |

| Diligent Board Services | ICT services |

| Dirty Food Pty Ltd | Event management services |

| Duy Dash | Photography services |

| East End Cellars | Event catering services |

| Elliot Grafton Creative | Video production services |

| Emma Humphreys Communications Ltd | Public relations services |

| Empired Ltd | ICT services |

| Encore Event Technologies Pty Ltd | Event production services |

| Entree Recruitment | Recruitment services |

| Ent Services Australia Pty Ltd | ICT services |

| Envyus Design Pty Ltd | Creative/design services |

| EP Bus Charters | Transport services |

| Event Managers Australia | Event management services |

| Event Timing Pty Ltd | Event infrastructure services |

| Eventelec Events Pty Ltd | Event infrastructure services |

| Exceptional Kangaroo Island | Tourism services |

| Experience Australia Group Pty Ltd | Cooperative marketing |

| Faith Lutheran College Inc | Event facilities |

| Fleurieu Cranes Pty Ltd | Event infrastructure services |

| Flight Centre Travel Group Pty Ltd | Cooperative marketing |

| F M Dawe and H G Richards | Photography services |

| Formile Events Pty Ltd | Traffic management services |

| Frame Creative Pty Ltd | Creative/design services |

| Frankie Films Pty Ltd | Video production services |

| Fringe Innovations Pty Ltd | Ticketing services |

| Full Throttle Management Pty Ltd | Event operations services |

| Gastronomo Pty Ltd | Catering services |

| Gearhouse Broadcast Pty Ltd | Event communications services |

| Giancarlo Truffa | Marketing representation services |

| Girl About Town Pty Ltd | Promotional services |

| Goin Off Safaris | Tourism services |

| Grace Records Management (Australia) Pty Ltd | Records management services |

| Gray Andreotti Advisory | Legal services |

| Gray Management Group Pty Ltd | Public relations services |

| GT Wine Group Pty Ltd | Advertising services |

| Gullivers Pacific Ltd | Cooperative marketing |

| Hamilton and Dune Pty Ltd | Accommodation services |

| Harry the Hirer Pty Ltd | Event infrastructure services |

| Harwood Electrical Automation Lighting & Safety Pty Ltd | Electrical services |

| Hays Specialist Recruitment (Australia) Pty Ltd | Temporary staff (backfill) |

| Health Safety Environment Australia Pty Ltd | Training services |

| Helloworld Services Pty Ltd | Cooperative marketing |

| Henrie Stride Management | Promotional services |

| Hoban Recruitment Pty Ltd | Temporary staff (labour) |

| Holidays of Australia Pty Ltd | Cooperative marketing |

| Holly & Co Catering | Catering services |

| Howard & Sons Pyrotechnics (Displays) Pty Ltd | Event production services |

| HTS Group Pty Ltd | Event infrastructure services |

| Hygge Studio Pty Ltd | Event infrastructure services |

| I am Helium Pty Ltd | ICT services |

| Ignite Holidays Pty Ltd | Cooperative marketing |

| Integrated Event Delivery Management | Event management services |

| Isentia Pty Ltd | Media monitoring |

| Ive Group Victoria Pty Ltd | Printing services |

| James Lyell | Entertainment services |

| JamFactory Contemporary Craft & Design Inc | Event trophies and awards |

| Jennie Bell Ink Pty Ltd | Event management services |

| Jetstar Airways Pty Ltd | Cooperative marketing |

| Johns Print Centre Pty Ltd | Printing services |

| Joshua Geelan | Photography services |

| Kalhaven Holdings Pty Ltd | Cooperative marketing |

| Kangaroo Island Sealink Pty Ltd | Cooperative marketing and transport services |

| Kantar Public Australia Pty Ltd | Market research |

| Kimberly Conte | Event management services |

| Koben Digital Pty Ltd | ICT services |

| Kojo Productions Pty Ltd | Video production services |

| KPP Ventures Pty Ltd | Temporary staff (backfill) |

| Layaway Travel Australia Pty Ltd | Cooperative marketing |

| Leader Computer Systems | ICT services |

| Lieb Management & Beteiligungs GmbH | Marketing representation services |

| Luxury Escapes Travel Pty Ltd | Cooperative marketing |

| Maria Elisabetta Pappalardi | Event operations services |

| Marshall Power Pty Ltd | Event infrastructure services |

| Matt Gilbertson | Promotional services |

| Matthew Keenan | Commentary services |

| McEwan Pty Ltd | Commentary services |

| McGregor Tan Research Pty Ltd | Market research |

| McLaren Vale Cheesemakers Pty Ltd | Event catering services |

| McMahon Services Australia Pty Ltd | Event infrastructure services |

| Meaghan K Coles | Photography services |

| Metal Fabricators Pty Ltd | Event infrastructure services |

| MI Associates Pty Ltd | Market research |

| Motor Racing Enterprises | Event operations services |

| Mount Lofty House | Accommodation/catering services |

| Naked Bookings Pty Ltd | Voucher agency service |

| Natrasha Pty Ltd | Event infrastructure services |

| NEC Australia Pty Ltd | ICT services |

| NEC IT Services Australia Pty Ltd | ICT services |

| Nestle Australia Ltd | Equipment rental |

| News Pty Ltd | Advertising services |

| Newstyle Printing Co Pty Ltd | Printing services |

| Nexstage Staging and Rigging Technologies Pty Ltd | Event infrastructure services |

| Nicholas Bellotti | Video production services |

| Nick Stock | Event operations services |

| Noortquip Rentals Pty Ltd | Event infrastructure services |

| Nova 91.9 Pty Ltd | Advertising services |

| Novatech Creative Event Technology Pty Ltd | Event production services |

| NTT Australia Pty Ltd | ICT services |

| NZME Publishing Ltd | Advertising services |

| Oaks Hotels and Resorts Ltd | Cooperative marketing |

| O’Brien Electrical Adelaide | Event infrastructure services |

| Oceanview Eco Villas | Accommodation/catering services |

| O’Shea’s Organisation Pty Ltd | Cleaning services |

| Pel-Air Aviation Pty Ltd | Transport services |

| Perlubie Holdings Pty Ltd | Accommodation services |

| Peter Fuller & Associates Pty Ltd | Video production services |

| Pierre Vives Tourism Consulting | Marketing representation services |

| Phil Hoffmann Travel | Cooperative marketing |

| Pineapple Media (SA) Pty Ltd | Production and broadcast services |

| Pink Fence Pty Ltd | Event infrastructure services |

| Pivotal Business Technology Pty Ltd | ICT services |

| Power On Solutions Pty Ltd | Event communications services |

| PPI Promotion & Apparel Pty Ltd | Promotional merchandise and uniforms |

| PR & GO UP Communication Partners SRL | Public relations services |

| Publicis Communications Australia Pty Ltd | Public relations services |

| PWE Plus GmbH | Advertising services |

| Qantas Airways Ltd | Cooperative marketing and transport services |

| Qantas Group Accommodation Pty Ltd | Cooperative marketing |

| Railroad Contractors of Australia Pty Ltd | Event infrastructure services |

| Regional Express Holdings Ltd | Cooperative marketing |

| Ricoh Australia Pty Ltd | Printing services |

| Roadside Services and Solutions Pty Ltd | Tourism infrastructure |

| Royal Agricultural & Horticultural Society of SA Inc | Event facilities |

| Royal Automobile Association of SA Inc | Cooperative marketing |

| SA Lift and Loader Pty Ltd | Equipment rental |

| Same River Studio | Video production services |

| Samuel Smith & Son Pty Ltd | Event catering services |

| Satalyst Pty Ltd | ICT services |

| Scene This | Creative/design services |

| Select Music Agency Pty Ltd | Entertainment services |

| Seppeltsfield Road Distillers Pty Ltd | Event catering services |

| Seppeltsfield Wines Pty Ltd | Event catering services |

| Seven Network (Operations) Ltd | Advertising services |

| Shanghai Linzhi Information Technology Development Co Ltd | Marketing representation services |

| Shimano Australia Cycling Pty Ltd | Event operations services |

| Showpony Adelaide Pty Ltd | Creative/design services |

| Showpony Advertising | Creative/design services |

| Sign Event Pty Ltd | Event infrastructure services |

| Sitecore Australia Pty Ltd | ICT services |

| Sitehost Pty Ltd | Event facilities, catering and accommodation services |

| Skee Kee International Pty Ltd | Event operations services |

| Skycity Adelaide Pty Ltd | Accommodation services |

| Sloe Food Company Pty Ltd | Event catering services |

| Socialbakers A.S. | Digital marketing services |

| Society Marketing Communications Pty Ltd | Digital marketing services |

| South Aussie with Cosi Pty Ltd | Production and broadcast services |

| Specialised Event Solutions Pty Ltd | Event infrastructure services |

| Specialised Solutions Pty Ltd | Event infrastructure services |

| Splashdown (Aust) Corporate Bathroom Rentals Pty Ltd | Event infrastructure services |

| Squeezy Digital Pty Ltd | Training services |

| SRS Security Pty Ltd | Event security services |

| St John Ambulance Australia SA Inc | Event operations services |

| Stayz Pty Ltd | Cooperative marketing |

| Stewie's Rigging and Hire Pty Ltd | Event infrastructure services |

| STR Global Ltd | Market research |

| Strava Inc | Digital services |

| Sunset Food and Wine | Event catering services |

| Sunstate Airlines (Qld) Pty Ltd | Transport services |

| Superloop Broadband Pty Ltd | Event infrastructure services |

| TalentID.com.au Pty Ltd | Promotional services |

| TBWA Melbourne Pty Ltd | Creative/design services |

| TBWA New Zealand Ltd | Creative/design services |

| TDaily Pty Ltd | Advertising services |

| Telstra Corporation Ltd | Telecommunications services |

| TFH Hire Services Pty Ltd | Event infrastructure services |

| The Gomez Creative Trust | Promotional services |

| The Stylist’s Guide | Catering services |

| Think! X Innovations Inc | Market research |

| Thomson Geer Adelaide | Legal services |

| Ticketmates Australia Pty Ltd | Cooperative marketing |

| Titan Containers Australia | Event infrastructure services |

| TLA Worldwide (Aust) Pty Ltd | Public relations services |

| Topline Promotions Pty Ltd | Promotional merchandise and uniforms |

| Tourism Australia | Administrative, marketing, promotional and training services and market research. |

| Tourism eSchool | Training services |

| Traffic Group Australia Pty Ltd | Event operations services |

| Travel Daily Media Pte Ltd | Advertising services |

| Travel Link Digital Co Ltd | Training services |

| Travellers Choice Ltd | Cooperative marketing |

| Travelscape LLC | Cooperative marketing |

| Travlr Pty Ltd | Digital services |

| Tripadvisor Singapore Pte Ltd | Advertising services |

| Trustee for Darlu Trust | Event facilities and catering services |

| Trustee for Eckersley Development Trust | Accommodation services |

| Trustee for Forman Family Trust | Photography services |

| Trustee for Karryon Trust | Advertising services |

| Trustee for Outback Encounter Trust | Training and tourism services |

| Trustee for Parsons Plumbing and Gas | Event infrastructure services |

| Trustee for TIR Family Trust | Temporary staff (labour) |

| Valsport Pty Ltd | Promotional services |

| Village Gate | Printing services |

| Virgin Australia Airlines Pty Ltd | Advertising services |

| Virtuoso Australia Pty Ltd | Cooperative marketing |

| Visualcom Pty Ltd | Event operations services |

| Voice of Cycling SPV Pty Ltd | Video production and promotional services |

| Wagstaff Worldwide Inc | Marketing representation services |

| Wavemaker Australia Pty Ltd | Advertising services |

| WDM Design and Advertising Pty Ltd | Creative/design services |

| Webjet Marketing Pty Ltd | Cooperative marketing |

| Wejugo Pty Ltd | Digital services |

| Wilson Parking Australia Pty Ltd | Parking services |

| Winc Australia Pty Limited | Storage and distribution services |

| Workspace Commercial Furniture Pty Ltd | Event infrastructure services |

| Yaao Marketing Consulting Co Ltd | Marketing representation services |

Data for previous years is available at: https://data.sa.gov.au/data/dataset/contractors-reporting-south-australian-tourism-commission

The details of South Australian Government-awarded contracts for goods, services, and works are displayed on the SA Tenders and Contracts website. View the agency list of contracts.

The website also provides details of across government contracts.

None to report.

Risk and audit at a glance

The Audit and Risk Committee assists the SATC Board in fulfilling its responsibilities relating to the annual financial statements as well as reviewing the adequacy of the SATC’s accounting and reporting systems, internal controls, risk management practices, and administrative policies and procedures. The Committee’s roles and responsibilities and scope are defined in its Terms of Reference.

The SATC is committed to ensuring that a risk management approach is applied to all business activities to ensure that the Agency maximises opportunities while not exposing the organisation to unacceptable levels of risk. The SATC aims to ensure that risk management is embedded in its decision-making, processes, and culture, and contributes to the achievement of its strategic objectives.

The SATC’s risk management practices are based on the International Risk Management Standard (ISO 31000:2018). In 2020-21 the SATC’s risk management framework was updated to reflect the new Risk Management Guide released by the South Australian Financing Authority (SAFA) and changes to the South Australian Government’s procurement processes which came into effect on 1 July 2021. The Framework provides minimum requirements and practical guidance to all staff on how to implement risk management processes across a wide range of activities undertaken by the SATC.

The SATC continued to manage its risks throughout the year by undertaking regular reviews of the risk register, developing detailed risk management plans for SATC managed events, and completing risk assessments for new projects and procurements.

The annual Business Continuity Plan test was undertaken in December 2020 and key learnings from this exercise were actioned and business continuity processes and documentation updated accordingly.

| Category/nature of fraud |

Number of instances

|

| Nil | Nil |

Strategies implemented to control and prevent fraud

The SATC is committed to maintaining a work environment free of fraud and corrupt behaviour. The SATC has in place appropriate fraud prevention, detection, investigation, reporting and data collection procedures and policies, in line with its fraud risk assessment and Fraud and Corruption Policy. The SATC offers protection to genuine whistleblowers to enable disclosure of illegal activities or corruption to be made. These arrangements meet the specific needs of the SATC, and all reasonable measures to minimise the incidence of fraud, as well as to investigate and recover the proceeds of fraud, have been taken.

Data for previous years is available at: https://data.sa.gov.au/data/dataset/fraud-reporting-south-australian-tourism-commission

Number of occasions on which public interest information has been disclosed to a responsible officer of the agency under the Public Interest Disclosure Act 2018:

Nil

Data for the previous five years is available at: https://data.sa.gov.au/data/dataset/whistle-blowers-reporting-south-australian-tourism-commission

Note: Disclosure of public interest information was previously reported under the Whistleblowers Protection Act 1993 and repealed by the Public Interest Disclosure Act 2018 on 1/7/2019.

Act or regulation

South Australian Tourism Commission Act 1993

Requirement

(1) The Commission must, on or before 30 September in every year, forward to the Minister a report on the Commission's operations for the preceding financial year.

(2) The report must contain—

(a) the audited statements of account of the Commission for the preceding financial year; and

(b) a report on—

(i) the state of tourism and the tourism industry in the State; and

(ii) the Commission's plans and the extent to which they have been implemented; and

(iii) the extent to which the Commission met the targets set in the performance agreement for the preceding financial year; and

(c) any other information required by or under the provisions of this Act or any other Act.

(i) report on the state of tourism and the tourism industry in the state.

South Australia’s visitor economy continues to be significantly impacted by the ongoing and world-wide effects of the COVID-19 pandemic. International travel bans, lockdowns and border closures across Australia have all taken a toll on our state’s tourism industry. Having not only realised but exceeded our 2020 target of growing South Australia’s visitor economy to its record $8.1 billion one year early in December 2019, 2020-21 has provided a stark contrast.

We have experienced the most severe contraction of tourism on record – with our $8.1 billion visitor economy decreasing to $4.4 billion in the year to March 2021. The latest results for the June 2021 year end have seen expenditure recover to $5.8 billion, ahead of our original impact forecast of $4.9 billion. Our model is now anticipating a recovery of the visitor economy to $6.3 billion by this time next year, as we pursue our ambitious 2030 target of $12.8 billion. The initial recovery has been led by strong growth in interstate expenditure over the last quarter and the record high intrastate expenditure in response to the easing of COVID-related travel restrictions. While positive, we could expect to see fluctuations in the data in the coming months and year due to the ever changing nature of the pandemic.

Nonetheless, South Australians are keen to do their bit for our economy by holidaying at home. There is also a huge opportunity to tap into a growing domestic market and challenge South Australians to redirect some of the $3.3 billion that was spent overseas in 2019 to tourism experiences here in our state.

Pre-COVID, our industry comprised 18,000 tourism businesses which employed 40,500 people. In terms of tourism employment, the most recent data we have is to 2019-20 which only takes into account four months of the impacts of COVID travel restrictions and reflects the job keeper program. Therefore, minimal impacts on tourism employment are reflected in the results. People employed directly in tourism in South Australia decreased 0.3 per cent to 40,400 in the year ending June 2020, compared to 2018-19. The full effect of the pandemic on tourism jobs will not be seen until we receive the 2020-21 State Tourism Satellite Accounts in June 2022.

Our focus over the past financial year has been on helping our visitor economy recover as quickly as possible so we can get back on track to reaching our 2030 goals.

Marketing

With international travel off the cards for the foreseeable future, the SATC redirected its international marketing budget to intrastate and interstate marketing. Two marketing campaigns ran in 2020-21, ‘A Great State To Be In’ and ‘For Those Who Want A Little More’. ‘A Great State To Be In’ ran throughout the year, promoting seasonally relevant products and destinations. Launched in May 2021, ‘For Those Who Want A Little More’ promoted South Australia’s unique products and experiences. Both campaigns were supported with PR activity.

The Great State Voucher initiative, launched in October 2020, has been an important stimulus for our state’s tourism industry. Designed to get consumers booking accommodation and experiences in Adelaide and the regions, the first four rounds of the scheme have injected $64.7 million into our state’s visitor economy. The vouchers have proved popular with consumers, the first two rounds were snapped up in 90 minutes and 39 minutes respectively. A ballot system for voucher allocation was set up for rounds three and four to ensure a fair and equitable distribution.

Data from STR, an accommodation data aggregator, shows ongoing strong recovery in hotel occupancy assisted by the Great State Voucher program. The latest available data for regional hotel occupancy for June 2021 shows occupancy at 59 per cent, the seventh consecutive month where regional South Australia has achieved a record individual monthly result. Adelaide hotels were operating at an average of 19 per cent occupancy for the month of April 2020, recovering to 56 per cent for October 2020 when the first ‘Great State Voucher’ program came into market. During 2021 we continued to see ongoing recovery, driven by the second round of the ‘Great State Voucher’ program, with January reaching 64 per cent occupancy, February 63 per cent, March coming in at a post-COVID record high of 72 per cent and April 70 per cent. While encouraging, Adelaide has yet to return to activity levels comparable to the pre-COVID period.

‘A Year of SA Wine’ campaign, which was launched in January 2021, will continue to run throughout the calendar year, encouraging South Australians to travel to wine regions and experience wine festivals and events. The campaign is aimed at driving additional visitation, generating economic benefit through new expenditure, supporting local businesses and job creation.

In response to the opening of the travel bubble between New Zealand and Australia in April 2021, the SATC launched the ‘Hey New Zealand’ campaign promoting South Australia’s landscapes and wide-open spaces, its food and wine offerings and Adelaide as the gateway. The campaign included a television commercial, digital and social advertisements aimed at driving awareness of Adelaide and South Australia as a holiday destination of choice and Air New Zealand’s direct Auckland to Adelaide flights. The campaign has seen nearly 27,000 New Zealanders visit southaustralia.com, with 2,209 ATDW and partner leads from 25 April 2021 to 30 June 2021.

Events South Australia

The events landscape has undergone significant change and 2020-21 has seen the industry ‘pivot’, ‘pirouette’ and ‘re-imagine’ the way things are done so the show can go on. During this time, the SATC delivered three of its managed events in COVIDsafe formats. They were:

- 14 November 2020: National Pharmacies Christmas Pageant, staged as a twilight arena spectacular at Adelaide Oval. The event ticketing was fully allocated, attracting more than 20,000 people. It was broadcast exclusively on Nine and 9Now with the audience peaking at 168,000 viewers, making it the highest viewed show on television in South Australia outside of the AFL Grand Final in 2020.

- 19-24 January 2021: Santos Festival of Cycling (Santos Tour Down Under replacement event). A domestic cycling event aimed at supporting the sport, showcasing six different cycling disciplines (road, track, BMX, mountain bike, cyclo-cross and para-cycling). The event attracted 500 elite athletes and showcased our state through the Seven network and 7Plus streaming platform. It achieved an audience of more than 3.7 million and a total PR value of more than $71 million.

- 30 April-9 May 2021: Tasting Australia presented by RAA Travel saw 54,000 people across the 10-day festival visit the COVID-safe Town Square in Victoria Square/Tarntanyangga and more than 90 events sold out across Adelaide and regional South Australia. It achieved a PR value of more than $25 million through national and local media coverage.

The other SATC managed event, the Bridgestone World Solar Challenge, will not go ahead in its traditional format in October 2021. This is due to the complexities of international border closures for an event that would need to bring in around 630 international participants. Instead, a virtual program, featuring a telemetry challenge and forums will take place between September and October. The SATC remains

steadfastly committed to the Bridgestone World Solar Challenge – a biennial event next scheduled to take place in October 2023.

As announced in October 2020, the Superloop Adelaide 500 did not go ahead in 2021 due to the impact of COVID-19 on one of the biggest event-builds in the state and the inability to recoup costs in a pandemic. The SATC also decided it would not seek a new sanction agreement beyond 2021.

The funds previously allocated to the Superloop Adelaide 500 have been transferred into the SATC’s Leisure Events Bid Fund from 2021-22 onwards. The additional funds will be used to secure and support a mix of ongoing and one-off events to drive visitation and economic benefit for South Australia and to promote South Australia as a tourism destination. In 2020-21 the funds were allocated to activities to stimulate the

visitor economy and drive activity into the CBD and regional South Australia, including the Great State Voucher program.

In 2020-21 the Leisure Events Bid Fund secured a range of events including:

- 2020 Repco Supersprint (19 to 20 September) and the 2020 OTR Supersprint (26 to 27 September) were held at The Bend Motorsport Park.

- A Day at the Drive and the Adelaide International WTA 500 (tennis events). Collectively these events attracted 23,543 fans and were broadcast globally across 32 networks in over 200 territories.

- 2021 Australian Masters Rowing Championships (held from 27 to 30 May 2021) and World Cup 3 Replica Rowing Regatta (held from 10 to 12 June 2021) brought approximately 1,700 athletes, officials and accompanying supporters to Adelaide.

- The Australian Baseball League moved part of its 2021 season to Adelaide from 14 to 20 January 2021. Participating teams included Brisbane, Perth, Canberra and Adelaide.

- 2023 Australian Masters Games. The eight-day sporting festival to be held in October 2023, is expected to attract approximately 9,000 athletes to compete in 45 sports in 70 venues across the state.

- NRL 2023 Ampol State of Origin. Adelaide will host Game 1 or 2 of the Ampol State of Origin Series, more than 20,000 interstate visitors are expected to inject an estimated $15 million into the South Australian economy.

- Moving Portraits by Robert Wilson at the Art Gallery of South Australia. The Archie 100 exhibition will be complemented by an Australian exclusive – Moving Portraits by Robert Wilson (from 9 July to 3 October 2022). Showcasing some of the nation’s most iconic art works, coupled with video portraits by renowned New York theatre director Robert Wilson.

- Illuminate Adelaide regions – Illuminate Adelaide announced three events in regional South Australia, commencing with Digital Gardens in Mount Gambier from 9 June to 4 July 2021. It is estimated that 10,000 people viewed installations across the Cave Garden precinct during a four-week opening.

Regional events and festivals are an important component of our events calendar as they drive visitation across the state by giving people a reason to travel ‘right now’. In 2020-21, 44 events, comprising 15 major events and 29 regional events within the Regional Events and Festival Program (REFP) were provided with sponsorship funding. In January 2021, a further $1 million was announced for the Regional Events Fund (previously REFP) to spur new and innovative regional events and to grow existing events right across the state from 2021-22.

The team had a significant focus on providing support to the industry around COVID impacts and delivering COVID Safe events. This work will continue to be a focus in 2021-22.

Destination Development

Work continued on developing appealing and accessible tourism infrastructure and experiences and working with our tourism industry and the private sector to make this happen.

A key project for 2020-21 has been the delivery of the $20 million Tourism Industry Development Fund (TIDF). It aims to assist the recovery of regional tourism by encouraging regional operators to improve and diversify so they can attract more visitors and get a higher return on their offering. As of 30 June 2021, a total of $8.3 million in grants had been allocated to 53 projects with a project value of over $31.6 million, creating almost 800 jobs. We are seeing a strong demand within the intrastate market to travel to our regions, with these shovel-ready projects delivering new experiences and opportunities for regions.

The aviation space has undergone significant change with international travel closed for the time being and interstate travel subject to ad hoc border closures. While the demand for airline travel has reduced dramatically, there is confidence that there will come a time when it will resume. In the meantime, this downtime has given the airlines the ability to test the market by opening new routes they might not have

considered prior to 2020. We’ve seen examples of this during 2020-21 including the new Qantas flight: Melbourne-Mt Gambier-Adelaide and Rex jet flights between Melbourne and Adelaide which both commenced in March 2021. In May, Qantas also announced the establishment of an Embraer E190s aircraft base in South Australia which will create up to 200 jobs when fully operational.

In May 2021, Adelaide welcomed Air New Zealand back following the opening of the trans-Tasman travel bubble. Pre-COVID, New Zealand was South Australia’s fourth largest international inbound market, with a record 43,000 trips made by Kiwis to our state in 2019. While the travel bubble has been suspended due to the impact of COVID-19, we look forward to welcoming tourists from our key markets when it is safe to do so.

On the accommodation front, we’ve seen continued investment from the private sector which is a real vote of confidence for our state. In 2020-21 six hotels opened creating a total of 894 new rooms. With more major hotels currently in the works (Sofitel, due to open in October 2021 and GPO Marriott International, due to open in 2023), it’s great to see we’ll have increased capacity to accommodate more visitors when borders re-open again. In the meantime, these projects are supporting employment in our state and South Australians are supporting these new developments by holidaying at home, with the Great State Voucher program offering an incentive to book ‘right now’.

In March 2021 our state’s tourism industry launched its plan to grow the state’s regional tourism sector to $4 billion (currently $3.6 billion) by 2025. The 2025 South Australian Regional Visitor Strategy (RVS) outlines priority action areas set by the state’s 11 tourism regions after extensive consultation involving more than 800 stakeholders. It builds on the success of the 2020 strategy, which saw the then regional tourism target of $3.55 billion by December 2020 met and exceeded more than one year early.

In some positive news for the state’s cruise industry, the first steps towards smooth sailing were taken in February when Australian-flagged Coral Expeditions undertook a 10-day tour of the remote South Australian coast. Extensive COVID-safe protocols were put in place which ensured the 99 passengers and crew were kept safe and healthy and could enjoy their journey. The SATC is in liaison with Coral Expeditions

regarding its 2021-22 expedition itineraries to South Australia.

While the impact of the COVID-19 pandemic has significantly changed our state’s tourism industry, we remain committed to working with our industry and government to recover our record $8.1 billion visitor economy, on our way to $12.8 billion by 2030.

(ii) the Commission's plans and the extent to which they have been implemented.

This information is outlined throughout the 2020-21 Annual Report.

(iii) the extent to which the Commission met the targets set in the performance agreement for the preceding financial year.

The SATC’s Board Performance Agreement and Board Performance Agreement Report can be found at Appendix B and Appendix C at the end of the 2020-21 Annual Report.

Reporting required under the Carers’ Recognition Act 2005

Not applicable to the agency.

Public complaints

Number of public complaints reported

| Complaint categories | Sub-categories | Example | Number of Complaints 2020-21 |

| Professional behaviour | Staff attitude | Failure to demonstrate values such as empathy, respect, fairness, courtesy, extra mile; cultural competency | 0 |

| Professional behaviour | Staff competency | Failure to action service request; poorly informed decisions; incorrect or incomplete service provided | 0 |

| Professional behaviour | Staff knowledge | Lack of service specific knowledge; incomplete or out-of-date knowledge | 0 |

| Communication | Communication quality | Inadequate, delayed or absent communication with customer | 0 |

| Communication | Confidentiality | Customer’s confidentiality or privacy not respected; information shared incorrectly | 0 |

| Service delivery | Systems/technology | System offline; inaccessible to customer; incorrect result/information provided; poor system design | 4 |

| Service delivery | Access to services | Service difficult to find; location poor; facilities/ environment poor standard; not accessible to customers with disabilities | 1 |

| Service delivery | Process | Processing error; incorrect process used; delay in processing application; process not customer responsive | 0 |

| Policy | Policy application | Incorrect policy interpretation; incorrect policy applied; conflicting policy advice given | 3 |

| Policy | Policy content | Policy content difficult to understand; policy unreasonable or disadvantages customer | 1 |

| Service quality | Information | Incorrect, incomplete, out dated or inadequate information; not fit for purpose | 0 |

| Service quality | Access to information | Information displayed was to understand, hard to find or difficult to use; not plain English | 0 |

| Service quality | Timeliness | Lack of staff punctuality; excessive waiting times (outside of service standard); timelines not met | 0 |

| Service quality | Safety | Maintenance; personal or family safety; duty of care not shown; poor security service/ premises; poor cleanliness | 0 |

| Service quality | Service responsiveness | Service design doesn’t meet customer needs; poor service fit with customer expectations | 0 |

| No case to answer | No case to answer | Third party; insufficient information to investigate | 25 |

| Total | 34 |

| Additional metrics | Total |

| Number of positive feedback comments | N/A* |

| Number of negative feedback comments | N/A* |

| Total number of feedback comments | N/A* |

| % complaints resolved within policy timeframes | N/A* |

Data for previous years is available at: https://data.sa.gov.au/data/dataset/public-complaints-reporting-south-australian-tourism-commission

* In line with PC039- Complaint Management in the South Australian Public Sector, the SATC is in the process of developing a new complaints policy and process, including the implementation of a new Complaint Management System which will allow for collecting, reporting and monitoring complaints and feedback to inform service improvement.

Compliance statement

The SATC is compliant with Premier and Cabinet Circular 039 – complaint management in the South Australian public sector: N* (see above)

The SATC has communicated the content of PC 039 and the agency’s related complaints policies and procedures to employees: N* (see above)